About Us

The Importance of Insurance: Safeguarding your assets and future

Insurance is a must-have for business owners. You have worked hard to build your brand, and without the right protection, even a small incident can cause major setbacks. This will cover risks like allergic reactions, infections, and accidental damage, while also protecting studio equipment, property, and income from unexpected events. With this tailored coverage, entrepreneurs can focus on their craft knowing their business is protected from potential risks.

Protect your Art

In the event that an accident does occur at your Piercing studio, Tattoo Parlor or Smoke Shop. General and Professional Liability is there to protect you and your business. Don’t leave your passion unprotected.

Peace of Mind

Don’t leave your business unprotected. Insurance is there for life tough moments, make sure you have an agent you can trust!

Protect you most important asset, you.

For anyone who relies on their hands to do their job, an injury can be a career-ending setback. Our Accident and Disability Insurance gives you peace of mind, ensuring that if you are ever unable to use your hands, you're financially covered. Whether you are an artist, piercer, or any hands-on professional, this coverage lets you focus on your work, knowing you’re protected from life’s unexpected twists.

Insurance

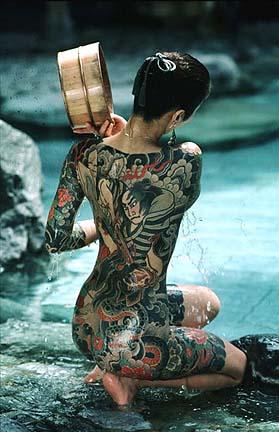

Tattoo Shop Insurance Coverage Options

Tattoo Parlors

Body Piercing

Artists

Self Defense liability Coverage

Smoke Shops

Services

SERVICES WE CAN COVER

Our insurance company has safeguarded dreams. We’ve weathered storms, rebuilt lives, and protected legacies. Empowering generations, our unwavering commitment stands strong. Trust us to shield your future’s chapters.

Commercial General Liability

You have the appropriate level of protection for your needs. This involves assessing risks, determining coverage limits, etc.

Professional Liability

Efficient and fair claims processing. This involves assisting you in filing claims, conducting investigations when necessary, etc.

Products Liability

We offer risk management guidance to help you to identify potential risks and implement strategies to minimized.

Property coverage

We educate and inform you about insurance-related matters. We offering resources, articles, and others.

Disability and Specialty body part coverage

We Offer you to make online payment portals, automatic payment plans, or alternative payment methods.

Premises Liability

Timely and knowledgeable assistance should be available through various channels, including phone, email, and online chat.

Personal Liability

We educate and inform you about insurance-related matters. We offering resources, articles, and others.

Self Defense Liability

We Offer you to make online payment portals, automatic payment plans, or alternative payment methods.

Alleged Assault and Battery, Sexual Abuse and Molestation Liability

We offer loss prevention services to help you minimize potential risks. This can involve conducting inspections, etc.,

Communicable Disease Liability

We offer customizable coverage solutions, allowing you to select appropriate coverage levels, deductibles, and additional endorsements.

Life Insurance

We Offer you to make online payment portals, automatic payment plans, or alternative payment methods.

Special Events Liability

Timely and knowledgeable assistance should be available through various channels, including phone, email, and online chat.

Your agents with Inksperience

Your Trusted Team For Tackling the Unexpected

Testimonials

What our clients say

At Inksurance, we are committed to delivering exceptional service to our clients. Our job is not complete until you are fully satisfied.

FAQs

About Tattoo Shop Liability Insurance

Insurance company FAQs address common inquiries about coverage, claims, premiums, and policy details for customer clarity.

professional liability insurance, typically covers claims related to ink allergies or infections caused to clients. This coverage can help pay for medical expenses and legal fees if a client experiences an allergic reaction or infection as a result of getting a tattoo at your shop. It is important to review the specifics of your policy with your insurance provider to ensure these types of incidents are covered.

Tattoo shop insurance is a specialized policy designed to protect tattoo artists and their businesses from various risks, including liability claims, property damage, and business interruptions.

It is essential to protect your business from potential lawsuits, cover medical expenses in case of accidents or infections, and safeguard your equipment and property from damage or theft.

Coverage typically includes general liability, professional liability, property damage, business interruption, and equipment protection. It may also cover employee injuries and cyber liability for data breaches. Contact us for a no obligation policy review.

The cost varies based on factors such as the size of your business, location, number of employees, and the level of coverage you choose. It’s best to get a personalized quote to understand your specific costs. Coverages is not as expensive as you think and we will work with you to find the option that works best for you.

Yes, most insurance providers offer customizable policies to meet the unique needs of your tattoo shop, allowing you to add specific coverages that are relevant to your business.

Consider the types of risks your business faces, the value of your equipment and property, the number of employees, and any specific needs related to your clientele. Ensure the policy covers all potential risks adequately.

Professional liability insurance, also known as errors and omissions insurance, covers claims related to the professional services you provide. This includes allegations of negligence, mistakes, or failure to deliver the expected results.

This depends on the policy. Some insurance plans may cover independent contractors working in your shop, while others may require them to have their own insurance. It’s important to clarify this with your provider.

In case of an incident, contact your insurance provider as soon as possible to report the claim. Provide all necessary documentation and details about the incident to ensure a smooth and efficient claims process.

To get a quote, contact an insurance provider specializing in tattoo shop insurance. You’ll need to provide information about your business, including its size, location, and specific coverage needs.

It’s advisable to review your insurance policy annually or whenever significant changes occur in your business, such as expansions, new services, or changes in the number of employees. This ensures your coverage remains adequate and up to date.

Yes, there is coverage available if you tattoo outside the us.

Yes, we offer temporary and permanent disability if you lose the ability to preform your daily activities.

No, we offer premium financing options to help spread your premium over a period of time to minimize the financial burden

That depends on what the shop already has in place. Reach out to us and we can help you navigate your needs.

We are not oblivious to some of the crazy things that can happen from time to time when dealing with the general public. We have options to protect you both criminally and civilly if a self defense situation arises.